FOR IMMEDIATE RELEASE

April is National Social Security Month

By Darlynda Bogle, Acting Assistant Deputy Commissioner

It’s National Social Security Month and this year we’re highlighting some of the time-saving features of the my Social Security account. Once you create an account, you’ll see that we already have your work history and secure information to estimate what you could receive once you start collecting benefits. With your personal my Social Security account, you can also:

Request a replacement Social Security card;

Set up or change direct deposit;

Get a proof of income letter;

Change your address;

Check the status of your Social Security application; and

Get a Social Security 1099 form (SSA-1099).

For over 80 years, Social Security has worked to meet the changing needs of the American public. Today, you can apply for retirement, disability, and Medicare benefits online, as well as take care of other business.

Knowledge is power. You care about your friends’ and family’s future, so encourage them to create a my Social Security account. Celebrate National Social Security Month by learning what you can do online anytime, anywhere.

FOR IMMEDIATE RELEASE

Why Social Security Retirement is Important to Women

Posted on March 7, 2019 by Jim Borland, Acting Deputy Commissioner for Communications

Social Security plays an especially important role in providing economic security for women. In the 21st century, more women work, pay Social Security taxes, and earn credit toward monthly retirement income than at any other time in our nation’s history. But, women face greater economic challenges in retirement. Women:

tend to live longer than men. A woman who is 65 years old today can expect to live, on average, until about 87, while a 65-year-old man can expect to live, on average, until about 84;

often have lower lifetime earnings than men; and

may reach retirement with smaller pensions and other assets than men.

Social Security offers a basic level of protection to all women. When you work, you pay taxes into the Social Security system, providing for your own benefits. In addition, your spouse’s earnings can give you Social Security coverage as well. Women who don’t work are often covered through their spouses’ work. When their spouses retire, become disabled, or die, women can receive benefits.

If you’re a worker age 18 or older, you can get a Social Security Statement online. Your Statement is a valuable tool to help you plan a secure financial future, and we recommend that you look at it each year. Your Statement provides a record of your earnings. To create an account online and review your Statement, visit our website.

If your spouse dies, you can get widow’s benefits if you’re age 60 or older. If you have a disability, you can get widow’s benefits as early as age 50. Your benefit amount will depend on your age and on the amount your deceased spouse was entitled to at the time of death. If your spouse was receiving reduced benefits, your survivor benefit will be based on that amount.

You may be eligible for widow’s benefits and Medicare before age 65 if you have a disability and are entitled to benefits. You also may be eligible for benefits if you are caring for a child who is younger than 16.

Our “People Like Me” website for women has valuable resources for people of all ages.

To read more about how we can help you, read and share the publication What Every Woman Should Know.

FOR IMMEDIATE RELEASE

GET YOUR SOCIAL SECURITY BENEFIT STATEMENT (SSA-1099)

By Becky Whitlow, Social Security District Manager in Springfield, IL

Tax season is approaching, and Social Security has made replacing your annual Benefit Statement even easier. The Benefit Statement is also known as the SSA-1099 or the SSA-1042S. Now you can get a copy of your 1099 anytime and anywhere you want using our online services.

A Social Security 1099 is a tax form Social Security mails each year in January to people who receive Social Security benefits. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

If you live in the United States and you need a replacement form SSA-1099 or SSA-1042S, simply go online and request an instant, printable replacement form through your personal my Social Security account at www.socialsecurity.gov/myaccount.

A replacement SSA-1099 or SSA-1042S is available for the previous tax year after February 1.

If you already have a my Social Security account, you can log in to your online account to view and print your SSA-1099 or SSA-1042S. If you don’t have access to a printer, you can save the document on your computer or laptop or even email it. If you don’t have a my Social Security account, creating one is very easy to do and usually takes less than 10 minutes.

If you receive benefits or have Medicare, your my Social Security account is also the best way to:

o Get your benefit verification letter;

o Check your benefit and payment information;

o Change your address and phone number;

o Change your direct deposit information;

o Request a replacement Medicare card; or

o Report your wages if you work and receive Social Security disability insurance or Supplemental Security Income (SSI) benefits.

If you’re a noncitizen who lives outside of the United States and you received or repaid Social Security benefits last year, we will send you form SSA-1042S in the mail. The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI).

With a personal my Social Security account, you can do much of your business with us online, on your time, like get a copy of your SSA-1099 form. Visit www.socialsecurity.gov to find out

FOR IMMEDIATE RELEASE

SOCIAL SECURITY AND SELF EMPLOYMENT

By Becky Whitlow, Social Security District Manager in Springfield, IL

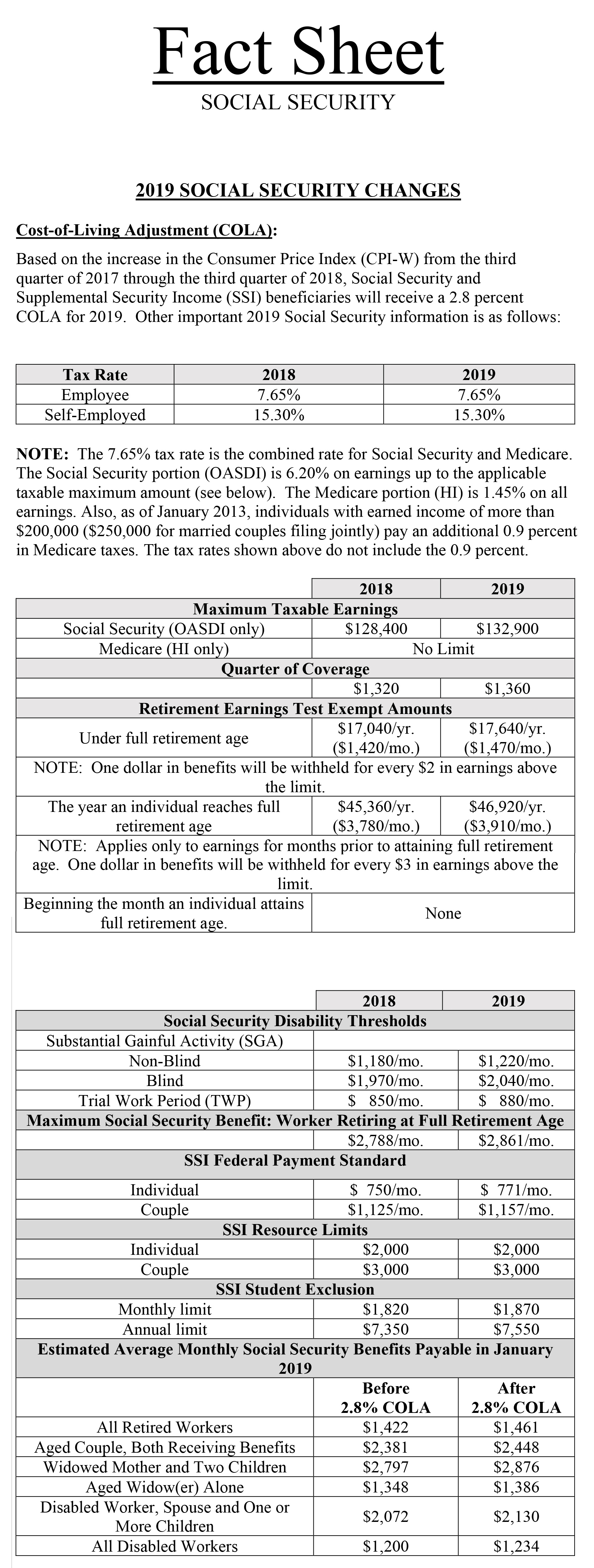

If you are not self-employed, Social Security taxes are typically taken out of your paycheck automatically. You and your employer each pay a 6.2 percent Social Security tax on up to

$132,900 of your earnings and a 1.45 percent Medicare tax on all earnings in 2019. You don’t have to do anything extra for the coverage you will one day receive because your employers handle the deduction as well as matching that contribution. Then they send the taxes to the Internal Revenue Service (IRS) and report your wages to Social Security.

If you’re self-employed, the process is a little different. You report your earnings for Social Security and pay your taxes directly to the IRS when you file your federal income tax return. You pay the combined employee and employer amount, which is a 12.4 percent Social Security tax on up to $132,900 of your net earnings and a 2.9 percent Medicare tax on your entire net earnings in 2019. You are considered self-employed if you operate a trade, business or profession, either by yourself or as a partner. If your net earnings are $400 or more in a year, you must report your earnings on Schedule SE, in addition to other tax forms you must file.

Net earnings for Social Security are your gross earnings from your trade or business, minus your allowable business deductions and depreciation. Some income doesn’t count for Social Security and shouldn’t be included in figuring your net earnings.

You must have worked and paid Social Security taxes for a certain length of time to get Social Security benefits. The amount of time you need to work depends on your date of birth, but no one needs more than 10 years of work.

You can read more about self-employment and Social Security at www.socialsecurity.gov/pubs/EN-05-10022.pdf.

FOR IMMEDIATE RELEASE

UNDERSTANDING SOCIAL SECURITY SURVIVORS BENEFITS

In February, our nation honors African Americans by celebrating Black History Month.

By Becky Whitlow, Social Security District Manager in Springfield, IL

Unfortunately, tragedy can strike without any warning. The loss of the family wage earner can be devastating both emotionally and financially. Social Security helps by providing income for the families of workers who die.

Some of the Social Security taxes you pay go toward survivors benefits for workers and their families. The value of the survivors benefits you have under Social Security may even be more than the value of your individual life insurance. When you die, certain members of your family may be eligible for survivors benefits. These include widows and widowers (and divorced widows and widowers), children, and dependent parents.

Here are the people who can get survivors benefits based on your work:

o Your widow or widower may be able to get full benefits at full retirement age. The full retirement age for survivors is age 66 for people born in 1945-1956, with the full retirement age gradually increasing to age 67 for people born in 1962 or later. Your widow or widower can get reduced benefits as early as age 60. If your surviving spouse is disabled, benefits can begin as early as age 50.

o Your widow or widower can get benefits at any age if they take care of your child younger than age 16 or disabled, who is receiving Social Security benefits.

o Your unmarried children, younger than age 18 (or up to age 19 if they’re attending elementary or secondary school full time), can also get benefits. Your children can get benefits at any age if they were disabled before age 22. Under certain circumstances, we can also pay benefits to your stepchildren, grandchildren, stepgrandchildren, or adopted children.

o Your dependent parents can get benefits if they’re age 62 or older. (For your parents to qualify as dependents, you must have provided at least half of their support.)

You can read more about Survivors Benefits at www .soc ials ecurity.go v/pu bs/EN-05- 10084.pdf.

How much your family can get from Social Security depends on your average lifetime earnings. The more you earned, the more their benefits will be. For more information on widows, widowers, and other survivors, visit www.socialsecurity.gov/planners/survivors.

Social Security is with you through life’s journey. Be sure to tell friends and family about our Survivors Benefits and how we can help in times of need.

FOR IMMEDIATE RELEASE

SOCIAL SECURITY AND BLACK HISTORY MONTH

By Becky Whitlow, Social Security District Manager in Springfield, IL

In February, our nation honors African Americans by celebrating Black History Month.

Recognizing our shared history is one way we can affirm our belief in freedom and democracy for all. For more than 80 years, Social Security has helped secure today and tomorrow with financial benefits, information, and tools for people of countless backgrounds and ethnicities that make up our richly diverse country.

One of our popular tools is the online Retirement Estimator. With it, you can plug in some basic information to get an instant, personalized estimate of your future benefits. Different life events or choices can alter the course of your future, so try out different scenarios such as higher and lower future earnings amounts and various retirement dates to get a good prediction of how it can change your future benefit amounts. You can access it at www.socials ecurity.go v/benefits/retirement/estimator.html.

If you find that helpful, we have a number of calculators to help you prepare for retirement at www.socialsecurity.gov/planners/calculators.

We also pay disability benefits to people with medical conditions that could prevent them from working for 12 or more months or result in death. If the disabled person has dependent family members, they may also be eligible to receive payments.

We pay disability through two programs: the Social Security Disability Insurance program, for people who have worked and paid Social Security taxes long enough to be eligible, and the Supplemental Security Income program, which is a means-tested program for people who are 65 or older, as well as people of any age, including children, who are blind or have disabilities.

Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits. Social Security helps by providing income for the families of workers who die. In fact, 98 of every 100 children could get benefits if a working parent dies. And Social Security pays more benefits to children than any other federal program.

You can learn more about retirement, survivors, and disability benefits, at www.socialsecurity.gov/benefits. Social Security is with you through life’s journey, helping secure today and tomorrow for you and your family. Visit us today at www.socialsecurity.gov/people/africanamericans.

FOR IMMEDIATE RELEASE

SOCIAL SECURITY AND AMERICA SAVES WEEK

By Becky Whitlow, Social Security District Manager in Springfield, IL

Planning and saving are core elements to a successful retirement. For over 80 years, Social Security has helped Americans achieve that goal. And each year, the American Savings Education Council and America Saves coordinate America Saves Week. The week is an opportunity for organizations to promote good savings behavior; it is also a great time for people to assess their own saving status.

Social Security is collaborating with America Saves Week to promote our shared mission of helping millions of people prepare for their future. This year, we’re celebrating the week from February 25 through March 2. Join the #ASW19 movement by using this hashtag when posting about your savings goals.

It’s never too early to start planning for your retirement. Set a goal, make a plan, and save automatically. Savers with a plan are twice as likely to save successfully. Pledge to save for America Saves Week at www.americasaves.org.

Social Security has many tools for retirement planning. You can access our online information and resources at www.socialsecurity.gov/planners/retire.

Younger people know that the earlier they start saving, the more their money can grow. Our website for young workers at www.socials ecurity.gov/people/earlycareer has resources that can help you secure today and tomorrow.

FOR IMMEDIATE RELEASE

SOCIAL SECURITY AND MEDICARE, WORKING SIDE BY SIDE

By Becky Whitlow, Social Security District Manager in Springfield, IL

Social Security and Medicare have worked side by side for decades. Both programs have improved the quality of life for millions of Americans.

Social Security reaches almost every family and, at some point, touches the lives of nearly all Americans. We’re with you through life’s journey — from birth to your golden years. Social Security helps older Americans, workers who become disabled, and families in which a spouse or parent dies. In 2017, about 174 million people worked and paid Social Security taxes and about 62 million people received monthly Social Security benefits.

We want you to understand what Social Security can mean to you and your family’s financial future. The publication, Understanding the Benefits, explains the basics of the Social Security retirement, disability, and survivors insurance programs. You can read it at www.socialsecurity.gov/pubs/EN-05-10024.pdf.

Unlike workers in the private sector, not all state or local government employees are covered by Social Security. Some only have their public pension coverage, and other government employees have both a public pension and Social Security coverage. For more information, please read our publication titled How State and Local Government Employees are Covered by Social Security and Medicare at www.socialsecurity.gov/pubs/EN-05-10051.pdf.

Medicare is the federal health insurance program for people who are 65 or older and certain younger people with disabilities. It is also for people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

The different parts of Medicare help cover specific services. Medicare Part A (hospital insurance) helps pay for inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part B (medical insurance) helps pay for certain doctors' services, outpatient care, medical supplies, and some preventive services.

Medicare Part C (Medicare Advantage plans) is a type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage plans provide all of your Part A and Part B benefits. Medicare Advantage plans may also include Medicare Part D (prescription drug coverage). Part D helps cover the cost of prescription drugs. Some people with limited resources and income may also be able to get Extra Help with the costs—monthly premiums, annual deductibles, and prescription co-payments—related to a Medicare prescription drug plan. The Extra Help is estimated to be worth about $4,900 per year. You must meet the resources and income requirements.

When you apply for Medicare, you can sign up for Part A (hospital insurance) and Part B (medical insurance). Because you must pay a premium for Part B coverage, you can turn it down. However, if you decide to enroll in Part B later on, you may have to pay a late enrollment penalty for as long as you have Part B coverage. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didn’t sign up for it, unless you qualify for a special enrollment period.

You can learn more about Medicare at www.socialsecurity.gov/benefits/medicare.

FOR IMMEDIATE RELEASE

WHY SOCIAL SECURITY RETIREMENT IS IMPORTANT TO WOMEN

By Becky Whitlow, Social Security District Manager in Springfield, IL

Social Security plays an especially important role in providing economic security for women. In the 21st century, more women work, pay Social Security taxes, and earn credit toward monthly retirement income than at any other time in our nation’s history. But, women face greater economic challenges in retirement. Women:

o tend to live longer than men. A woman who is 65 years old today can expect to live, on average, until about 87, while a 65-year-old man can expect to live, on average, until about 84;

o often have lower lifetime earnings than men; and

o may reach retirement with smaller pensions and other assets than men.

Social Security offers a basic level of protection to all women. When you work, you pay taxes into the Social Security system, providing for your own benefits. In addition, your spouse’s earnings can give you Social Security coverage as well. Women who don’t work are often covered through their spouses’ work. When their spouses retire, become disabled, or die, women can receive benefits.

If you’re a worker age 18 or older, you can get a Social Security Statement online. Your Statement is a valuable tool to help you plan a secure financial future, and we recommend that you look at it each year. Your Statement provides a record of your earnings. To create an account online and review your Statement, visit our website at www.socialsecurity.gov/myaccount.

If your spouse dies, you can get widow’s benefits if you’re age 60 or older. If you have a disability, you can get widow’s benefits as early as age 50. Your benefit amount will depend on your age and on the amount your deceased spouse was entitled to at the time of death. If your spouse was receiving reduced benefits, your survivor benefit will be based on that amount.

You may be eligible for widow’s benefits and Medicare before age 65 if you have a disability and are entitled to benefits. You also may be eligible for benefits if you are caring for a child who is younger than 16.

Our “People Like Me” website for women has valuable resources for people of all ages. You can access it at www.socialsecurity.gov/people/women.

To read more about how we can help you, read and share the publication What Every Woman Should Know at www.socialsecurity.gov/pubs/EN-05-10127.pdf.

FOR IMMEDIATE RELEASE

NEED TO CHANGE YOUR NAME ON YOUR SOCIAL SECURITY CARD?

By Becky Whitlow, Social Security District Manager in Springfield, IL

Are you changing your name? If so, let Social Security know so we can update your information, send you a corrected card, and make sure you get the benefits you’ve earned.

To change your name on your card, you must show us documents proving your legal name change and identity. If you are a U.S. citizen, you also must show us a document proving your U.S. citizenship, if it is not already in our records. You must present original documents or copies certified by the agency that issued them. We can’t accept photocopies or notarized copies.

To prove your legal name change, you must show one of the following documents:

o Marriage document;

o Divorce decree;

o Certificate of naturalization showing a new name; or

o Court order for a name change.

To prove your identity, you must show an unexpired document showing your name, identifying information, and photograph, such as one of the following:

o U.S. driver’s license;

o State-issued non-driver’s identification card; or

o U.S. passport.

If you don’t have one of those documents available, we may be able to accept your:

o Employer identification card;

o School identification card;

o Health insurance card; or

o U.S. military identification card.

To prove your U.S. citizenship, you must show one of the following documents:

o U.S. birth certificate;

o U.S. Consular Report of Birth Abroad;

o U.S. passport (unexpired);

o Certificate of Naturalization; or

o Certificate of Citizenship.

Whatever your reason for your name change, Social Security is here to help you with the new… you! Fill out the form at www.socialsecurity.gov/forms/ss-5.pdf and follow the instructions to ensure your Social Security card is delivered in a timely manner. You can also locate your local field office at www.socialsecurity.gov/locator so you can apply for your updated card and show your required documents in person.

For complete instructions, visit www.socialsecurity.gov/ssnumber, which includes information for non-citizens. And remember, if you simply need to replace a lost Social Security card, but don’t need to change your name, you can — in most states — request your replacement card online using your my Social Security account at www.socialsecurity.gov/myaccount.

FOR IMMEDIATE RELEASE

DON’T BE MISLED BY FALSE MEDICARE OR SOCIAL SECURITY ADS

By Becky Whitlow, Social Security District Manager in Springfield, IL

Online and otherwise, there’s a lot of information out there, and sometimes it’s difficult to tell what sources are credible. With millions of people relying on Social Security, scammers target audiences who are looking for program and benefit information.

The law that addresses misleading Social Security and Medicare advertising prohibits people or non-government businesses from using words or emblems that mislead others. Their advertising can’t lead people to believe that they represent, are somehow affiliated with, or endorsed or approved by Social Security or the Centers for Medicare & Medicaid Services (Medicare).

People are often misled by advertisers who use the terms “Social Security” or “Medicare”. Often, these companies offer Social Security services for a fee, even though the same services are available directly from Social Security free of charge. These services include getting:

o A corrected Social Security card showing a person’s married name;

o A Social Security card to replace a lost card;

o A Social Security Statement; and

o A Social Security number for a child.

If you receive misleading information about Social Security, send the complete ad, including the envelope, to:

Office of the Inspector General Fraud Hotline

Social Security Administration

P.O. Box 17768

Baltimore, MD 21235

You can learn more about how we combat fraudulent advertisers by reading our publication What You Need to Know About Misleading Advertising at www.socialsecurity.gov/pubs/EN-05-10005.pdf.

You can also report Social Security fraud to the Office of the Inspector General at oig.ssa.gov/report.

By Becky Whitlow,

Social Security District Manager in Springfield, IL

CHECKLIST FOR YOUR SOCIAL SECURITY ANNUAL CHECK-UP

|

|

Say “annual checkup” and most people imagine waiting at the doctor’s office. But, there’s another type of checkup that can give you a sense of wellness without even leaving home. Visit www.socialsecurity.gov and follow these five steps to conduct your own Social Security annual checkup.

Your Social Security Statement is available online anytime to everyone who has a my Social Security account at www.socialsecurity.gov/myaccount. Creating your account gives you 24/7 access to your personal information and makes it impossible for someone else to set up an account in your name. We still send paper Statements to those who are 60 and older who don’t have an account and aren’t receiving Social Security benefits. Your Statement provides information about work credits (you need 40 credits to be entitled to a Social Security retirement benefit), estimates for retirement, disability, and survivors benefits, plus a history of your earnings.

Work Credits Count

If you have earned 40 work credits, your Statement will show estimates for retirement, disability, and survivors benefits. If you don’t have 40 work credits, the Statement shows how many you have and how many you still need to qualify for benefits.

Review Earnings Record

Review your history of earnings year by year to make sure each year is correct. This is important because Social Security benefits are based on your lifetime earnings. If any years are incorrect or missing, you may not receive all the benefits you are entitled to in the future. If you need to correct your earnings, contact Social Security at 1-800-772-1213 between 7 a.m. and 7 p.m. Monday through Friday. Please have your W-2 or paystubs when you call.

Study Benefit Estimates

Review the section titled “Your Estimated Benefits.” Be sure to review not only your retirement estimate, but your disability and survivors estimates. No one likes to think about disability, but a 20-year-old worker has a one-in-four chance of becoming disabled before reaching retirement age, underscoring the importance of disability benefits. Since the value of the survivors insurance you have under Social Security may be more than your individual life insurance, be sure to check your survivors estimates also.

Calculate Additional Estimates

You can use our Retirement Estimator to compute future Social Security benefits by changing variables such as retirement dates and future earnings. If you want to project what future earnings could add to your benefit, visit www.socialsecurity.gov/estimator.

Schedule Your Annual Check-Up

Each year, make a date with yourself to review the most recently posted year of earnings on your Statement. By checking your record every year, you can be certain when you retire that Social Security will have a correct record of earnings to use when computing benefits for you or your family members.

Social Security helps you secure your today and tomorrow by providing information to make your financial planning easier. Social Security is more than retirement; it is a family protection plan. For more information about benefits, visit us at www.socialsecurity.gov.

By Becky Whitlow,

Social Security District Manager in Springfield, IL

SOCIAL SECURITY HONORS THE NATION’S HEROES ON MEMORIAL DAY

On Memorial Day, we honor service members who have given their lives for our nation. Social Security acknowledges the heroism and courage of our military service members, and we remember those who have given their lives to protect our country. Part of how we honor these heroes is the way we provide Social Security benefits.

The loss of a family member is difficult for anyone. Social Security helps by providing benefits to protect service members’ dependents. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits. You can learn more about Social Security survivors benefits at www.socialsecurity.gov/survivors.

It’s also important to recognize those service members who are still with us, especially those who have been wounded. Just as they served us, we have the obligation to serve them. Social Security has benefits to protect veterans when an injury prevents them from returning to active duty or performing other work.

Wounded military service members can also receive expedited processing of their Social Security disability claims. For example, Social Security will provide expedited processing of disability claims filed by veterans who have a U.S. Department of Veterans Affairs (VA) Compensation rating of 100 percent Permanent & Total (P&T). The VA and Social Security each have disability programs. You may find that you qualify for disability benefits through one program but not the other, or that you qualify for both. Depending on the situation, some family members of military personnel, including dependent children and, in some cases, spouses, may be eligible to receive Social Security benefits. You can get answers to commonly asked questions and find useful information about the application process at www.socialsecurity.gov/woundedwarriors.

Service members can also receive Social Security in addition to military retirement benefits. The good news is that your military retirement benefit generally does not reduce your Social Security retirement benefit. Learn more about Social Security retirement benefits at www.socialsecurity.gov/retirement. You may also want to visit the Military Service page of our Retirement Planner, available at www.socialsecurity.gov/planners/retire/veterans.html.

Service members are also eligible for Medicare at age 65. If you have health insurance from the VA or under the TRICARE or CHAMPVA programs, your health benefits may change, or end, when you become eligible for Medicare. Learn more about Medicare benefits at www.socialsecurity.gov/medicare.

In acknowledgment of those who died for our country, those who served, and those who serve today, we at Social Security honor and thank you.

By Becky Whitlow,

Social Security District Manager in Springfield, IL

SOCIAL SECURITY HONORS THE NATION’S HEROES ON MEMORIAL DAY

On Memorial Day, we honor service members who have given their lives for our nation. Social Security acknowledges the heroism and courage of our military service members, and we remember those who have given their lives to protect our country. Part of how we honor these heroes is the way we provide Social Security benefits.

The loss of a family member is difficult for anyone. Social Security helps by providing benefits to protect service members’ dependents. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits. You can learn more about Social Security survivors benefits at www.socialsecurity.gov/survivors.

It’s also important to recognize those service members who are still with us, especially those who have been wounded. Just as they served us, we have the obligation to serve them. Social Security has benefits to protect veterans when an injury prevents them from returning to active duty or performing other work.

Wounded military service members can also receive expedited processing of their Social Security disability claims. For example, Social Security will provide expedited processing of disability claims filed by veterans who have a U.S. Department of Veterans Affairs (VA) Compensation rating of 100 percent Permanent & Total (P&T). The VA and Social Security each have disability programs. You may find that you qualify for disability benefits through one program but not the other, or that you qualify for both. Depending on the situation, some family members of military personnel, including dependent children and, in some cases, spouses, may be eligible to receive Social Security benefits. You can get answers to commonly asked questions and find useful information about the application process at www.socialsecurity.gov/woundedwarriors.

Service members can also receive Social Security in addition to military retirement benefits. The good news is that your military retirement benefit generally does not reduce your Social Security retirement benefit. Learn more about Social Security retirement benefits at www.socialsecurity.gov/retirement. You may also want to visit the Military Service page of our Retirement Planner, available at www.socialsecurity.gov/planners/retire/veterans.html.

Service members are also eligible for Medicare at age 65. If you have health insurance from the VA or under the TRICARE or CHAMPVA programs, your health benefits may change, or end, when you become eligible for Medicare. Learn more about Medicare benefits at www.socialsecurity.gov/medicare.

In acknowledgment of those who died for our country, those who served, and those who serve today, we at Social Security honor and thank you.

By Becky Whitlow,

Social Security District Manager in Springfield, IL

SHARING SECURITY WITH MOM ON MOTHER’S DAY

Spring is upon us, and it marks two very popular annual events: Mother’s Day and the release of Social Security’s baby name list! There’s no better time to share some security with the people you love.

While spending time with your mom on Sunday, May 13, you can help her quickly and easily sign up for a free, online my Social Security account. You can do it from home, which means more time doing the things you want to do together.

Signing up for a my Social Security account will give Mom the tools she needs to stay on top of her Social Security benefits. When she signs up at www.socialsecurity.gov/myaccount, she can do a number of things.

If she does not receive benefits, she can:

• Request a replacement Social Security card if she meets certain requirements;

• Check the status of her application or appeal.

• Get her Social Security Statement, to review:

o Estimates of her future retirement, disability, and survivors benefits;

o Her earnings once a year to verify the amounts that we posted are correct; and

o The estimated Social Security and Medicare taxes she’s paid.

If she does receive benefits, she can:

• Request a replacement Social Security card if she meets certain requirements;

• Report her wages if she works and receives Disability Insurance benefits;

• Get her benefit verification letter;

• Check her benefit and payment information and her earnings record;

• Change her address and phone number;

• Start or change direct deposit of her benefit payment;

• Request a replacement Medicare card; and

• Get a replacement SSA-1099 or SSA-1042S for tax season.

Is Mom not yet receiving Social Security benefits and still planning her retirement? Does she need a little help calculating how her benefit amount fits in with her other income sources in retirement? It’s easy to get instant, personalized benefit estimates, too. Our Retirement Estimator is the only source that provides Mom with Social Security estimates based on her own earnings record. This allows her to receive the most accurate estimate of her future retirement benefits. Visit the Retirement Estimator at www.socialsecurity.gov/estimator.

Did you know that you and Mom can also share the 10 most popular male and female baby names of 2017? Social Security is the source for the most popular baby names, and we reveal the new names every year to celebrate Mother’s Day. Be sure to check our site around Mother’s Day at www.socialsecurity.gov/oact/babynames/.

Sharing information about Social Security and helping Mom sign up for a my Social Security account at www.socialsecurity.gov/myaccount is a meaningful gift that shows you really care.